Instant Payouts with delivery partners

About Instant Payouts

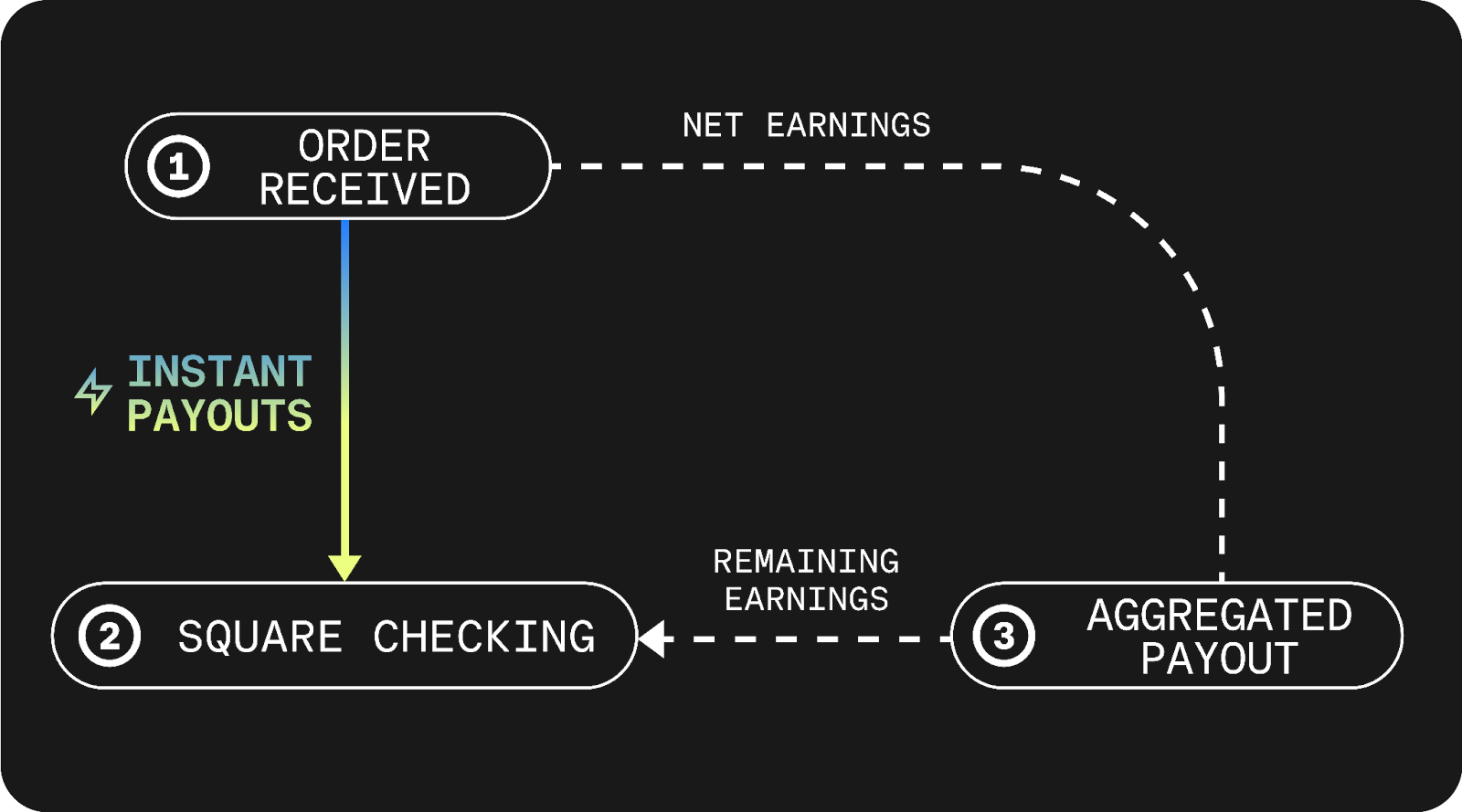

Instant Payouts provide immediate access to your earnings from orders fulfilled with delivery partners. Once an order is placed, Square will deposit your estimated net earnings into your Square Checking account balance. Because your payout rate is estimated based on your historical payouts and orders, your rate may not be consistent for every order and will be adjusted over time. Instant Payouts is currently only available with DoorDash, Uber Eats, and Grubhub.

Before you begin

Before you can use and receive Instant Payouts, you must meet all of the following requirements:

Integrate your Square account with a delivery partner. Learn how to integrate delivery and pickup apps.

Have a Square Checking account.

Receive your DoorDash, Uber Eats, and Grubhub payouts into your Square Checking account.

Instant Payouts is not the same feature as Instant Transfers. Learn how to set up and edit transfer options.

While using Instant Payouts, your deposits will be paused if you stop meeting any of these requirements. If you lose access, your next deposit may still be applied toward Instant Payouts. After that, you will receive your deposits as standard per your delivery partner’s payout schedule. Learn how to Review your Instant Payouts deposits.

Set up Instant Payouts

Sign in to Square Dashboard and go to Orders > Instant payouts.

Click Get Started > Set up Instant Payouts.

Choose a delivery partner and complete the checklist.

Once complete, you will see an Active icon next to the delivery partner.

Cancel Instant Payouts

If you want to stop using Instant Payouts, contact us at [email protected]. If Instant Payouts are canceled, we will stop funding your orders. If there are earnings that Square has already pre-funded but haven’t been paid yet, we will use your next deposit(s) to cover the remaining amount. After that, you will go back to your regular payout schedule per your delivery platform.

Related articles

Instant Payouts services require a Square Checking account. Funds provided through Instant Payouts services are generally available in the Square Checking account balance immediately after an order is processed. Fund availability times may vary due to technical issues. If an order is not paid out instantly, it will be available according to your regular deposit schedule. Payout limits, including limits on payout amounts, may apply.

Block, Inc. is a financial services platform and not an FDIC insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met.

Other trademarks and brands are the property of their respective owners.