Transfers Suspended FAQ

To ensure the financial security of both you and your customers, Square needs to collect additional information about the payments you’ve recently accepted before transferring your held funds.

Find answers to commonly asked questions about your Square account or suspended transfers.

Account Review

We ask for information about your business because it’s important to us that Square is a safe place to do business. We keep Square secure for all sellers by knowing the details of how you run your business – like the kinds of goods and services you sell, how you bill your customers and the way you manage your cash flow. And by helping us understand your business, we’re in a better position to provide you with resources to help you avoid payment disputes or fraudulent transactions.

Refer to our Information request FAQ to learn more.

While the review is occurring, we hold the funds to ensure that we understand what they are for and how your business is run so we can guarantee a safe trading environment.

We like to make signing up for an account as easy as possible, so we don’t require this information at sign up. We only reach out when we need a bit more information to verify your business or to make sure we understand the payments.

Square has a wide range of legal and regulatory obligations it must meet when providing account services to its customers. These are ongoing and don’t just apply at the account opening stage. To comply with these obligations, we may need to review accounts and the activity taking place on them.

There are likely some questions marked as optional in brackets. For these, you are not required to give an answer – fill in the provided form to the best of your ability. We’re looking for documentation to verify your business and the goods or services your business provides through Square.

If the submitted documentation isn’t sufficient, our Account Services team will contact you for additional information.

Once you’ve submitted all requested documentation, our Account Services team begins a review of your account. You’ll receive an email within 1 to 2 working days after the review, letting you know if more information is needed, or when you can expect to see the deposits resumed to your bank account.

You can see your active and completed information requests in your online Square Dashboard by going to Settings > Account & Settings > Information Requests.

Ongoing information requests: You can monitor the status of your requests and make updates to your responses until we start reviewing them. To upload your documents, select Continue. If you receive a new request while you have an information request in progress and need to send your supporting documents to us, select Start to respond to the new request.

‘Request history’ shows your completed information requests. Select View to review your submitted documents.

If you don’t have any ongoing or completed requests, your Information requests page will show ‘There are no active information requests at this time’.

The review process is set at 1 to 2 working days.

Helpful tip: The more information you provide, the better we will be able to understand your business and the quicker we’ll be able finish this review.

Yes. Square is committed to keeping your information safe, secure and private. All of our pages are secure and served via SSL/TLS. Square is also certified PCI compliant. For more information, read our Security Policy and Privacy Policy.

Without the requested information, our Account Services team will be unable to review your account and your transfers will remain suspended in your Square balance. If you’d prefer not to provide this information, you may attempt to refund the transactions and the associated fees and request payment from your customer(s) outside of Square.

We don’t request information from you after each payment. We are committed, however, to helping you process transactions in a way that keeps your business safe. You can help us avoid the need to ask you for more information by learning more about potential sources of fraud and following a few best practices around

accepting payment cards.

If you don’t want to provide the requested information, you may refund the transactions and request your customers complete their payment(s) outside of Square.

Transfers Suspended

Your transfers are likely suspended because we noticed some unusual activity on your Square account. Our system periodically reviews your transactions to keep your account safe from scams and fraud. This may not necessarily be the reason your transfers in particular are suspended, but our policy is to make sure your business is protected when our system notices something out of the ordinary.

- Australian Business Registration

- DBA

- Occupational license

- Official certification of trade

- Industry standard documentation

- Seller’s permit

- Articles of incorporation

If you don’t have a registered business, you can send us a copy of your government-issued identification.

- Driver’s license

- Passport

- Medicare Card

- Or International Equivalent

We want to assess the health of your business, which means that we need to make sure that you can support refunds or chargebacks if they happen. Seeing the bank statements will also help us to understand how the business operates.

The information we request is strictly confidential and used only for the sole purpose of further understanding your business.

Note: If the bank account in question is new, you can provide bank statements of a personal account you own. In this case, you should also provide documentation that includes your name and account number as proof that the new account is in your, or your business’, name.

Form Troubleshooting

Use a web browser – such as Safari, Google Chrome or Firefox – on a laptop, desktop computer, or mobile device.

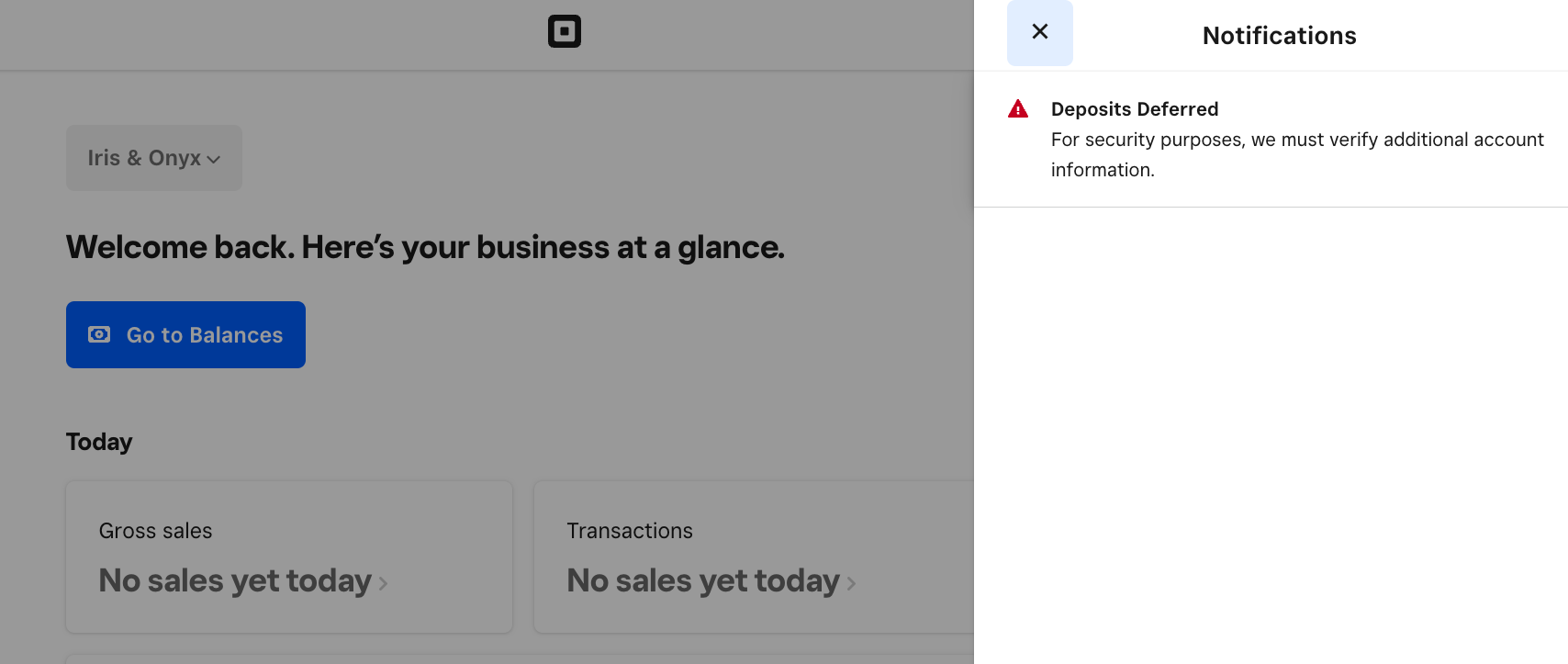

- Log in to your online Square Dashboard (not the Square POS app) and click the bell icon to open your notifications.

- Click Deposits Deferred to open the Square Account Verification Form.

- Fill in as much information as you can and upload the required information.

- Click Submit once you’re done.

Helpful Tip: Ensure JavaScript is enabled in your browser. In order to enable JavaScript, please follow these instructions depending on which browser you use: Firefox,Google Chrome or Safari. If that doesn’t help, try using a different browser or device.

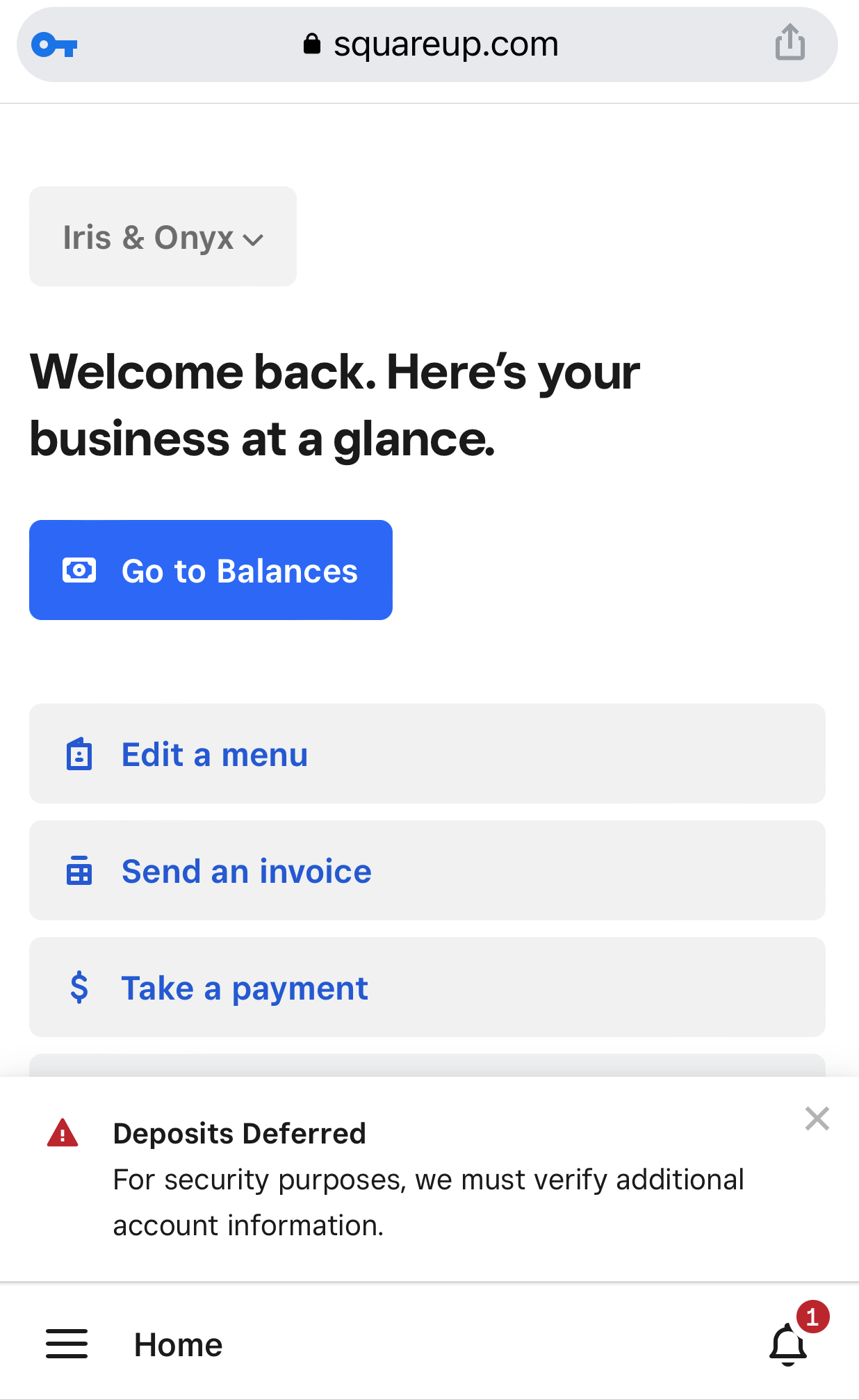

Yes! Use a mobile web browser such as Safari or Google Chrome to log in to your online Square Dashboard (not the Square POS app).

To access the electronic Information Request Form:

- Tap the bell icon to open your notifications.

- Tap Deposits Deferred.

- Fill out as much information as you can, then click Submit

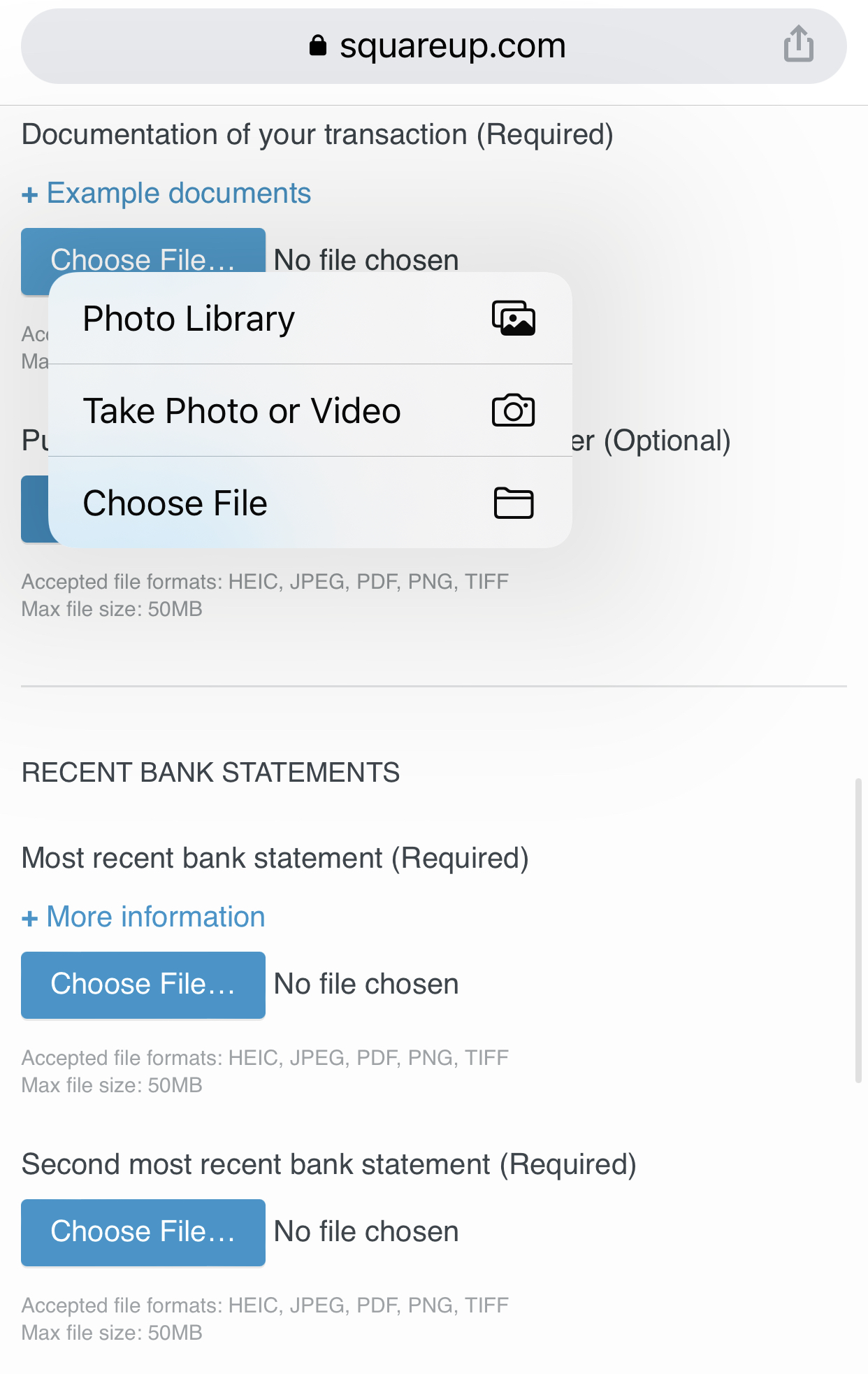

If you can’t scan the documents we need, you can also submit documentation from your smartphone. Click Choose File in the confirmation form. From there, you’ll have the option to take a photo of your documents or select a photo you’ve already taken from your image library.

You can fax the documents to us. First, fill out all fields on the form that don’t require file uploads. Then click Send via fax. Follow the instructions on this page. It’s important to use the cover page we provide – without it, we won’t be able to match your documents to your account, which will delay our ability to review your account.

Sample Questions

In this section, you can review questions similar to ones you may receive during a review, along with documentation request examples.

- Attach bank statements from the last three months in PDF format.

- Use statements from the bank account linked to your Square account. If you don’t have three months worth of statements, you may use an alternative account (like a personal bank account).

- These statements should show all debits and credits and the monthly balance summary.

- If you do not have access to online banking, ensure that screenshots or photographs include your account number and sort code for verification.

More Information

Read more about how Square keeps your business safe.